A Very Boring Finance Primer

The image above is me on the outside, ordering my ritual coffee after dropping the boys off each morning. As the month wears on, the hands clasp ever tighter, beseeching the credit gods to bless my purchase with their benevolent approval. My sunny smile fixes with a frightened rigor; the whites of my eyes, on display, lend an air of pre-surprise. My humor, more forced, approaches a total non-sequitur stream of consciousness to distract from the sinking feeling in my stomach. I just want to be in Jamaica, like right now.

I gotta stop worrying about my finances. It's eating up my whole life and taking time away from what's important. I can't even enjoy my tiny treat, because I'm so afraid of the consequences.

- I want to trust the balances in my accounts.

- I want to know when I will run out of money each month -- before I spend money.

- I want to see, instantly, how much extra or emergency I can afford.

- I want to feel supported as I change my habits so that I can make changes for a lifetime.

- I want to understand my trajectory and see how my purchase today affects it.

- I want stability and security.

- I want a rich life on a middle class budget.

Amen. I want all that and my morning latte too — some days with a pastry. I've got six kids in the middle of Seattle. We're just trying to get them launched and have some leftovers for retirement. Boring goals, I know. So, why are my finances 007-in -Jamaica exciting?

One question to repeatedly ask yourself is: Can my finances be any more boring? Here's the first quiz to start you thinking about it.

Where do you fit along the boring <--> exciting continuum?

Chances are that I rigged the test to make you look financially exciting. Maybe you actually are boring. Most of us in the US don't have enough saved to handle a $400 emergency. Paycheck-to-paycheck living is stressful. Getting a handle on your money is daunting and anxiety provoking.

There are so many ways to manage your finances and budget. When I read my list of blogs and books, I'm overwhelmed by the choices of tools and methods. All of them have a steep learning curve, for those of us . All of them need copious amounts of time and focus. Many have a particular bent Christian, FIRE, investment advice, buy expensive products, MLM.

Everyone promises you a silver bullet. Not one of those books, apps, or forums can disengage the brain's avoidance mechanisms long enough to make a difference. I often "forget" about our finances/budgets when they are too exciting. This one little thing should have been fine, and then we can't make a credit card payment. It's the Oopsalot Syndrome.

I haven't found a budgeting app yet that could manage my emotions, my finances, those of my partner, and our joint accounts. So I'm developing my own. And I hope you'll join me on this journey. It sucks to go it alone.

Interstix offers you community, support, and provable* methods to automate your money, allocate your time, and prioritize your relationships.

*These methods are not proven until they work for you, so I'm providing what I can free for a limited time. When you can show me how much you've saved, I'll invite you to our paid forums and newsletters. At some point, I'll offer you fair-priced access to our automated tools.

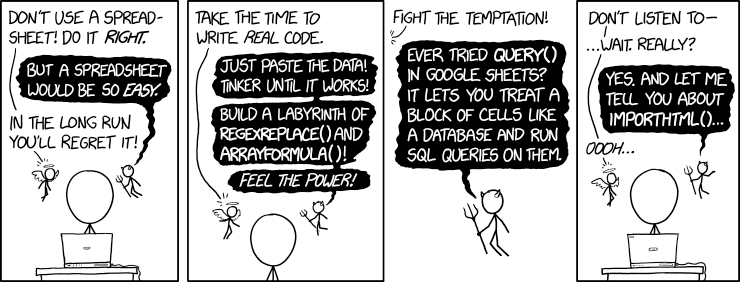

Exciting Sterns *no spreadsheets

After more than a decade together, my husband and I have an extremely active and exciting financial life. At my age, I was looking forward to financial Thanksgiving, not the Fourth of July. Thus, six kids later, with the second heading off to college, I thought it would be great to shake it up, change out a few things, like that avocado oil, no-carb, gluten-free, organic, paleo salad dressing in my fridge.

You know, add a little kosher balsamic vinegar to my power greens.

My husband was totally cool with that.

At my age, I was looking forward to financial Thanksgiving, not the Fourth of July.

What he was not cool with was my suggestion for a little role play reversal. I used my background in international finance and accounting to put together a budget using a spreadsheet. I have never been able to convince him that Supercalc was the best thing since Betty White. He was singularly unimpressed.

In fairness, my husband is a mathematician. He believes there's something wrong with floating-point calculations in most spreadsheet software. He can't abide spreadsheets. And this dude must abide where he is at. Over time, I realized that spreadsheets are not going to work in our home. Ever.

So DH became the total dungeon master (DM) of our finances. I gave the whole stay-at-home parent thing a whirl (wielding a dust mop instead of a magic wand). Just your typical Ultimate mom with a data science lab in her basement at playing with massive clusters at nap time and building Minecraft worlds on the sofa after snack.

And for a time he could hold our finances in his head. Once children Four, Five, and Six came along, the lack of sleep was draining and debilitating. Every so often I'd show DM a new budgeting app (You Need A Budget, Mint, Personal Capital, Mvelopes, Every Dollar). He shrugged a little without budging or budgeting.

Those budgeting apps focus on making our current life hell (move to atrailer park in the midwest, for instance), without the promise of a happy ending (Acorns would take 200 years to save up enough money to retire). None of available methods encouraged us to look at our best current life and build a future life worth living.

None of available methods encouraged us to look at our best current life and build a future life worth living.

Even switching us to Simple Banking with free integrated, automated budgeting wasn't enough. Now my husband complains that he can't see how much money is in our account. And I can't figure it out either, especially when on my cellphone with kids running around the store, breaking glass and spilling beans. We couldn't balance allocating expenses to budgeting categories with five kids still at home (three of them toddlers). I've spent weeks and months trying to get them to work, only to derail with emergencies, roadblocks, and my own family's needs.

We're expected to slap some huge financial goals together, input them into a spreadsheet, live on beans & rice, and invest all our money without a choice in the companies we want to support. Our dreams generally revolve around sleeping in on the weekends and maybe an afternoon nap on Saturday.

Even switching us to Simple Banking with free integrated, automated budgeting wasn't enough ... We couldn't balance allocating expenses to budgeting categories with five kids still at home ... I've spent days and months trying to get them to work ...

Despite tons of experience, advanced STEM degrees, and earning more than enough income, it all came to a head with a few thousand dollars in emergency plumbing repairs. We hit our wall. Our credit cards were maxed out, our equity was tapped out, and we had no more stock options to sell. My startup hasn't taken off, yet, and the last round of friends and family long spent. Worst, neither of us knew exactly when or how much the next bills to hit would be.

Despite tons of experience, advanced STEM degrees, and earning more than enough, it all came to a head ... Our credit cards were maxed out, our equity was tapped out, and we had no more stock options to sell.

All the oblique and cringeworthy (as my kids assure me) references can't change how dire our situation is. We're in the same boat as most other Americans --paycheck-to-paycheck and scrambling to cover $400. It feels like we're on the precipice edge, slipping, and there's no bottom visible.

Super exciting. I know.

Every attempt at implementing budgeting failed due to psychological and time impediments which are not addressed in any of the other content I've read. In fact other websites often blame the reader for their financial situation, increasing the stress and avoidance.

So, when things are so crazy, how do I get my family to boring? Welcome to the six steps.

Let's dive in!

Step 1: Catch Your Breath

Exciting finances are stressful. There is so much shame around money, just the thought of it makes many people anxious. Debt is such a constant dark cloud over one's head. The day-to-day is so overwhelming. It's hard to look up, let alone set goals or dream about the future.

It's so easy to slip into negative thinking: You may falter. You may stumble. You may even fail.

Here's the truth: Life is all about getting up and taking that next step.

Who knows about getting up better than Navy SEALs? The military provides a breathing technique to their troops to help them remain calm and focused under combat conditions. This simple technique will help you through stressful situations in your life.

It's called combat tactical breathing, aka "box breathing."

The implementation is simple:

- Breathe in counting 1, 2, 3, 4

- Hold your breath counting 1, 2, 3, 4.

- Exhale counting 1, 2, 3, 4

Repeat 4 times.

You've just taken the first step: Keep Breathing or as I like to call it:

Commit to Life!

It's so easy to slip into magical thinking: This is the winning lottery ticket. This plan is sure to work (if I only sit here long enough).

We all leave footprints, no matter how minimalist our approach. Choose your path according to your values and find others to walk with you along the way.

The relationships you make, your friends, family, and even strangers, will help you up and keep you going when your path is steep, rocky, and terrifying.

At the end of this post, we offer you a small gift. It's a curated list of resources and support, a gift from our private community to you. Subscribe to the free newsletter we'll send you the download link.

I'm just the first of many more people along your path. Take my hand and remember no judgment.

Step 2: Seriously. No. Judgment.

When it comes to money, we are not gentle with ourselves, and we are not honest. Some of us lose our hopes in the day-to-day grind. Others have our heads in the clouds, counting all our future chickens. Most of us work all day and late at night allow the glimmer of hope to shine through. Just enough to make until tomorrow, but never enough to start on our way.

There was no link between our day and our day-dreams until now.

Your path is the connection, your day-dreams your destination. Let's start with where you want to go ...

The second step is to visualize your perfect day without prejudice.

Dare to dream!

The more detailed you are, the more it will support the bridge between your day and the path to your dreams.

Step 3: Bridge The Interstix

Meanwhile, back on the ground, you may notice a vast chasm between where you are now and where you want to be, the interstix. We are going to bridge that gap.

Now would be an excellent time to practice your box breath from the first step. Suddenly many feel the urge to do anything but look at that wide yawning maw (bathing cats comes to my mind).

Typical financial advisors say something along the lines of "in 30 years with the miracle of compound interest... automatically invest."And you have only 10 or even as few as 5. You could even be on a fixed income now. Or worse, freshly squozen between your parents and 20-something kids. Advisors throw up their hands and saw, well "you're f***ed then." That is precisely the language they use when you can't hear them.

The TV advisors will tell you that you must give up every treat (like that latte) and oh, it's your fault you got so deep in debt. They love the blame and shame game.

Those advisors suck. They don't know you. They are in it for the money.

Are you still keeping your commitment to life? Keep breathing ...

Pull out one bank statement and enter income and expenses from last month.

Look at your spending. For each purchase note how you feel about it:

- Was it a surprise? Do you think, "oh, no," "where did that come from?", or "Ouch, that cost too much money?" Do you feel that little jump in your stomach? Maybe for you, it feels like a pit, or a sinking feeling. Did it overdraw your account? Are there any payments still associated a purchase made long ago?

- Did you love it? Was it one of those special moments with your community and friends? Do you feel yourself smiling at the memory? Would you do it again, if you could? Is there warmth spreading through your body at the memory? Did it feel just right? Was it worth it?

It can be both a surprise and you loved it (the dream Christmas with the bills due January, comes to mind). Go with your gut, your first instinct. This process is very primal and unique to you. If it's a recurring expense, you can always mark it differently the next time you see the expense.

No more surprises!

Spoilers for movies and shows are bad. Real bad.

Spoilers for your expenses and income? Well, wouldn't you like a heads up before discovering your bank account was empty. It's a lot easier to rob Peter to feed Paul, if Peter still has a slice of the pie available.

Step 4: Allocate Your Pie

Enter last month's paystubs. Adjust due dates & amounts (calculate returns) in the same worksheet. Add categories.

Get to Zero!

Step 5: Fiercest things first

rank from 0-6

Your priorities spectrum

Step 6: Take the helm

Is this on my way or in my way?

Conclusion

With these six steps you can get to boring.

If you join the public newsletter, I'm happy to send you worksheets you can print and fill out with real numbers and begin your journey. Each week you will receive a curated list of resources to help you on your path.